When thinking about due diligence in the context of Mergers & Acquisitions (M&A’s), most of the emphasis is on the financial, IP and legal aspects of the deal. Interestingly, the cultural dimension, which is well understood to be the key success factor in creating the valuable synergies in M&A deals is rarely an integral part of the due diligence process. As a result, synergies are always promised, but rarely delivered.

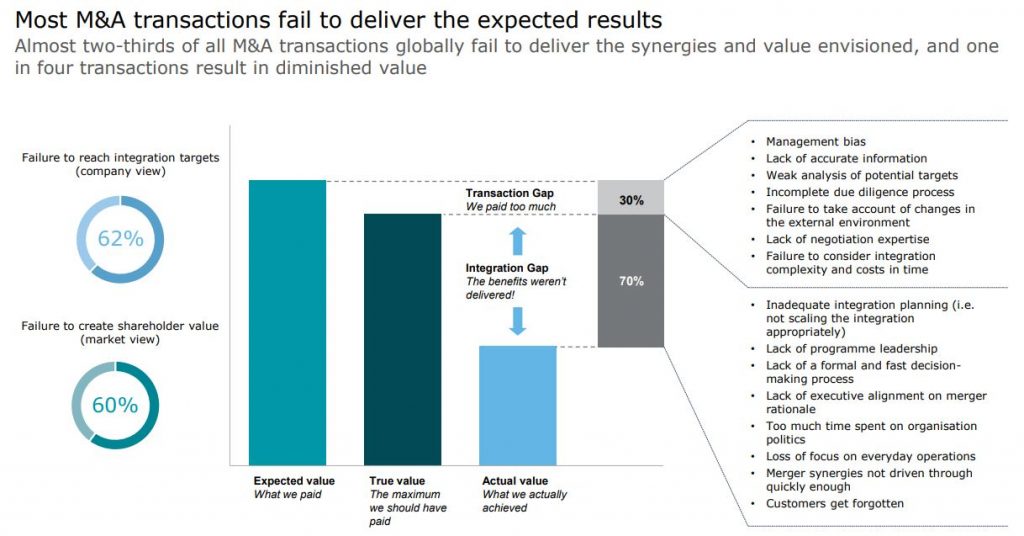

The following data points from Deloitte clearly show that a more proactive approach to predicting and managing the cultural dimension is key to unlocking the full potential of M&A deals. This makes sense, since the most important asset of any business today is its people and the shared values & beliefs that help them work towards a common goal. According to a recent survey by the National Bureau of Economic Research, nine out of 10 CEOs believe that a strong set of values and beliefs will increase their company’s business value and performance.

Isn’t it fascinating how readily we accept the gap between what we know and what we do? Even more so when it comes to things like human emotions, that are much more difficult to “understand, control and measure” than the financial or legal aspects of a business? Not surprisingly, we observe the same dilemma in the context of change initiatives. We know that 70% of them fail to deliver because we are reluctant to address the human mindset changes that need to accompany any transformation project.

At Being at Full Potential we have made it our life’s work to bring more visibility and action-ability to the deeper, human and cultural dimensions of an organization so that it becomes easier to work with in the context of these important strategic initiatives (for example, M&A deals, digital transformation projects and re-organization).

As thought leaders and practitioners in the “soft side of business”, we invite you to reflect (and act) on the following three steps that we have seen proactively embedded into a human first, cultural dimension in the M&A due diligence process with outstanding results.

1. Reframe how we think about cultural integration: Consider cultural maturity before cultural fit as a catalyst for positive and sustainable integration.

On the rare occasion when culture is proactively brought into the due diligence equation, we typically approach it from a “fit” perspective. In other words, we use tools that measure the cultural attributes and leadership paradigms of both organizations and look at how closely they overlap. We assume that the more aligned they are, the smoother the integration process will be and the easier it will be to create value. For example McKinsey’s Organizational Health Index (OHI) or the Merger Compatibility Assessment from the Barrett Values Center.

This, however, only tells part of the story, and often leads to overlooking the true synergy potential of two organizations coming together. Let’s consider marriage as a metaphor for M&A. No doubt that the most successful unions have some underlying values in common. Equally important though is the extent to which the couple respects and values each other’s differences and gives space to each other to fully be themselves. In this way it becomes easier to accept and constructively work through the inevitable challenges that arise once the honeymoon period is over.

Kahil Gibran describes it beautifully in The Prophet. This is what he says about marriage: “Fill each other’s cup but drink not from one cup. Give one another of your bread but eat not from the same loaf. Sing and dance together and be joyous, but let each one of you be alone, even as the strings of a lute are alone though they quiver with the same music”.

This may sound “soft” and idealistic. The reality we observe though, as Generation Y and Z grow into more strategic, leadership and executive roles, is one where this level of Human-first forethought – almost symbiosis- will not only differentiate companies, but also give them a competitive advantage.

In this symbiotic relationship then, acknowledging, respecting and understanding each other’s differences is the key to collaboration, and hence, unlocking synergies. It’s also the sign of a highly mature organization, which suggests that maturity, rather than fit, is what we should be striving for when evaluating the potential of M&A deals.

2. Understanding and assessing organizational maturity: What gets measured, gets done!

The Being at Full Potential Maturity Index is a robust way to measure where both individuals and organizations are on the maturity spectrum, and predicts how people are likely to behave in M&A situations.

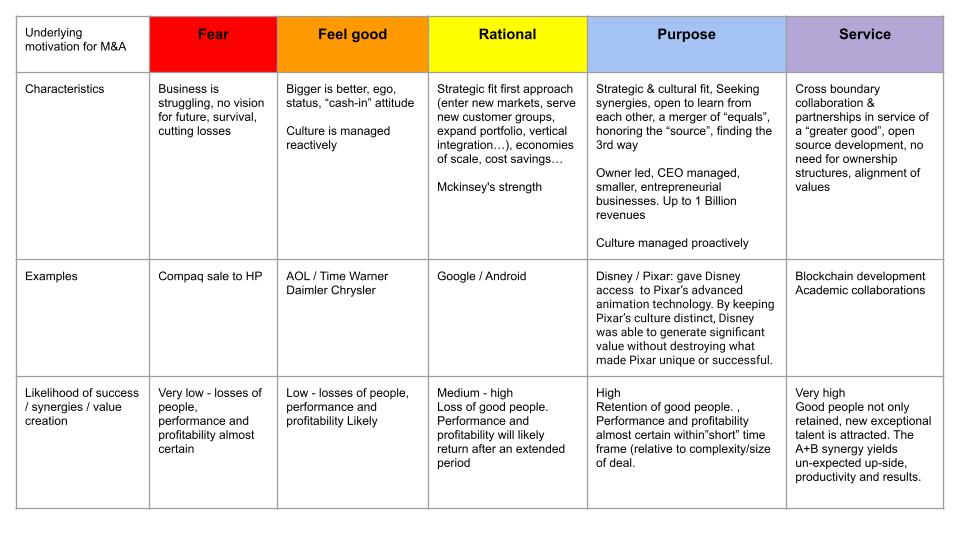

For example, an organization that is in the “Feel-Good based maturity” (See below table – Orange) will prioritize a sense of belonging. This translates into policies that ensure a higher level of conformity with guidelines that show how the employee should behave in solving problems or handling relationships with peers, managers, leaders and customers. The “feel good factor” generally overrides personal freedom, creativity and identity.

At this level of maturity it will be very challenging to embrace the diversity in thinking inherent in M&A deals. Instead the tendency will be for the acquiring company to impose their culture (or ways of doing things) on the acquired organization.

On the other hand, an organization operating in the Purpose-Based maturity (Blue) prioritizes:

- Honest and authentic conversations

- Feeling empowered and sense of ownership

- Closer collaboration

- Intuition in decision making

- Higher tolerance for risk taking

- Learning from mistakes

- Personal development is a priority

At this higher level of maturity it is easy to see how diversity in thinking becomes a key strength to leverage and further stimulate creativity and innovation.

The following table summarizes the 5 stages of organizational maturity, the behaviors we can expect at each stage and predicts the likelihood a M&A deal will create value for its stakeholders.

3. Bridging finance and culture: 6 human-centric measures to unleash value

M&A’s will inevitably increase the natural tension that already exists between finance and culture. The desire to drive up profitability in the short term (especially in target assets preparing for IPO/Sale) often comes at a high cost to the people. This “debt”, often unwittingly inherited by the acquiring company, always needs paying. As a result, it’s common to see morale drop, good people leave and short and long term value erode.

Finance typically has the upper hand in the M&A context, not necessarily because it’s more important, but because hard numbers are easier to measure and control and this is the prevailing western corporate narrative. In this way, the divide between the mind of a business and its heart is further torn apart. Measures like employee engagement or customer satisfaction try to bridge the gap but don’t reveal much about the underlying mindsets that form the basis of culture. Nor are they improving YoY as Forrester and Gallup reports clearly show, despite heavy focus and investment.

On the other hand, cultural dimensions like psychological safety, purpose, integrity and trust are great predictors of a healthy culture but can feel too far removed for the CFO, CEO and Board to integrate into the decision making process for M&A.

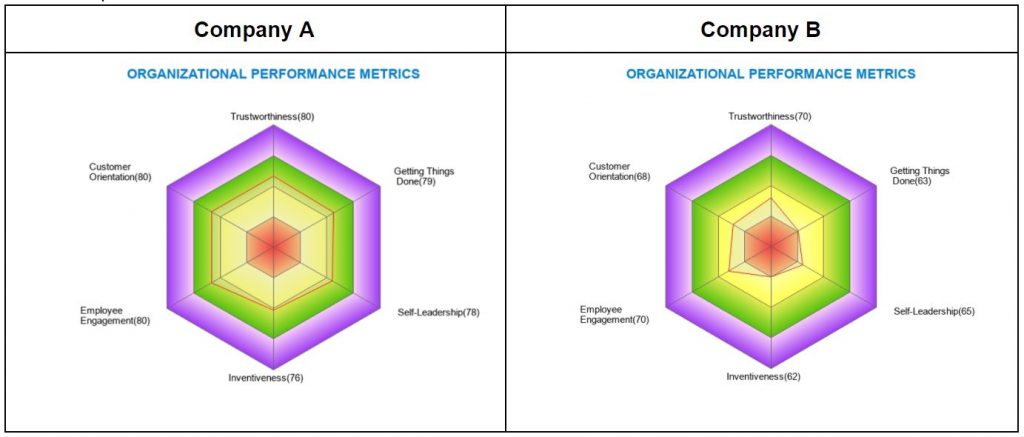

Being at Full Potential has developed 6 measures designed to integrate both cultural and performance dimensions of a business. We refer to them as the 6 Organizational Performance Metrics. They are aligned by proxy to critical corporate KPI’s as follows:

- Inventiveness (Relative Innovation Performance): Measures the extent to which the culture of an organization is conducive to creating radically new products and services (that may or may not have direct market application)

- Customer Orientation (Customer Experience KPI’s): Measures the extent to which the culture of an organization encourages genuine service to the explicit and implicit needs of its customers.

- Employee Engagement (Employee Experience KPI’s): Measures the extent to which an organization’s culture ignites dedication and commitment in a person’s day-to-day work activities

- Trustworthiness (Trust index by GPTW): Measures the extent to which an organization’s culture is deserving of the trust / confidence it receives from its stakeholders

- Self Leadership (Employee Sentiment/engagement e.g. GLINT): Measures the extent to which an organization’s culture encourages people to rely on their deeper values and principles when navigating the complexities of the organization

- Getting things done (Numerous Productivity KPI’s): Measures the extent to which an organization’s culture supports people’s ability to execute and deliver concrete results

Being able to assess and measure the 2 organizations coming together in a deal along these dimensions can prove to be incredibly insightful. Here’s an example of the type of output that would be available and the kinds of conversations it can open up.

In this situation we can see that company A is well expressed (green) on all 6 OPM’s (organizational performance metrics). Although there is still room to grow, performance is strong and it has an underlying culture to support it. Company B on the other hand, is under expressed (yellow) on all dimensions, meaning there is underutilized potential and an opportunity to strengthen the culture of the organization.

Having access to this data provides deep insight into the fundamentals of a business. Different profiles like this doesn’t necessarily mean that the “fit” between the two companies is not good. However, it does signal that the cultural & people aspects need to be better understood, and proactively addressed, in order to bring out the full value of the deal.

In this case, as part of the cultural due diligence, we would want to investigate why Company B is scoring so low on Getting Things Done, Inventiveness and Self Leadership. Bringing these measures up in line with Company A will unleash a significant amount of unexpressed potential, which in turn will also lead to significant breakthroughs in performance. The more attention we can bring to the cultural dimensions of performance, the more likely we will be able to tap into the synergy potential of mergers and acquisitions.

=============

For more information on how we can support you in the culture due diligence process please contact:

- Ben Hobkinson: ben@exponentialhumanpotential.com

- Mark Vandeneijnde: mark@beingatfullpotential.com